their explanation

their explanation make in life are inevitably going to be higher than others. That is why they say you win some and you lose some. The goal is to win excess of you lose, and studying this text and soaking up the forex ideas below will ensure that you just win extra trades than you lose when playing the market.

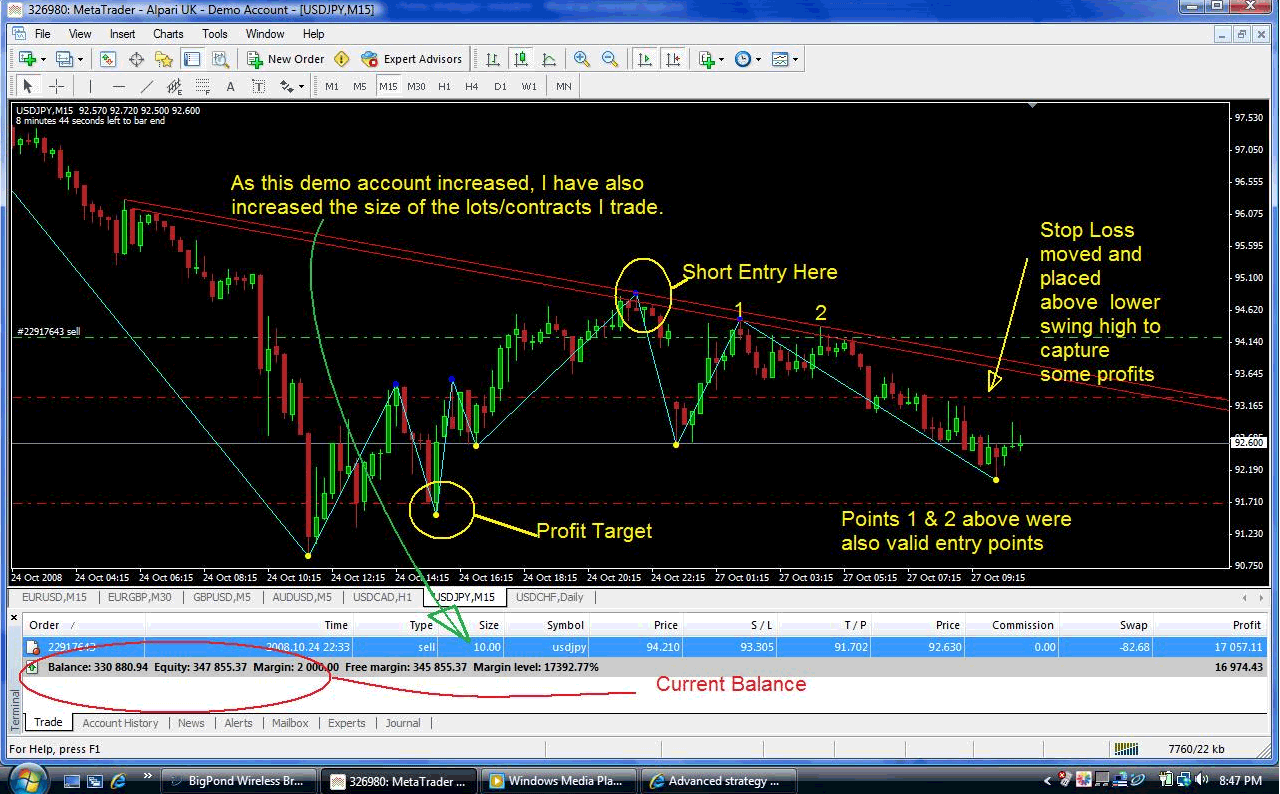

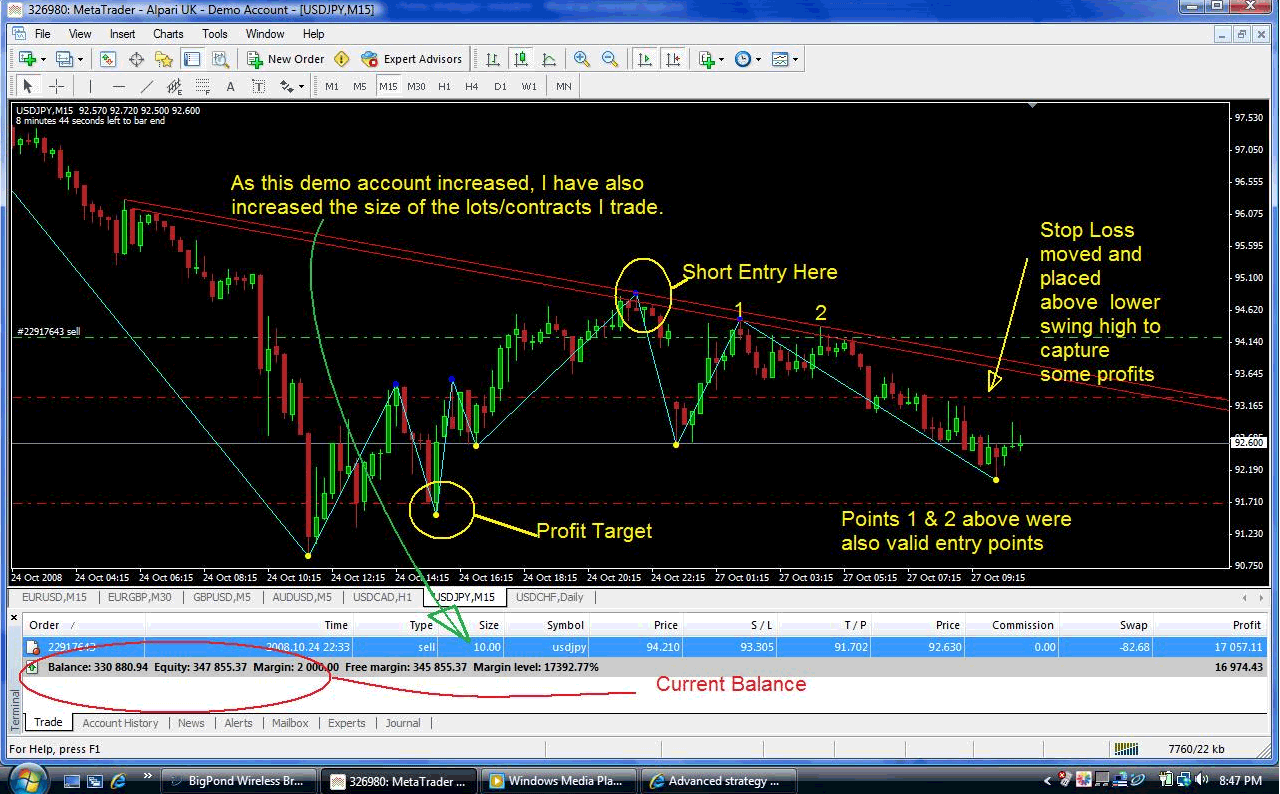

Forex buying and selling is normally highly leveraged. When working with large amounts of leverage a proper money administration technique is essential. By no means have greater than 2% of your capital and threat on a given trade or 6% of your capital at risk at any given time. This fashion, even when all the money you've gotten in danger is completely misplaced, you may still commerce once more the following day.

Watch emerging developments on forex and determine what path they're on for the time being. Typically it is advisable to try to earn money while currencies are falling, but usually a downward trend indicates that it'll proceed to fall. It's not usually advisable to try to gamble that it'll turn around.

Note that there are all the time up and down markets, but one will all the time be dominant. It is mostly fairly straightforward to promote signals in a growing market. Goal to select trades based on such developments.

Avoid shopping for any product that promises nice success or strategies.

top article haven't been tested and are unlikely to earn you enough to make them price the cost. You may guess that they are seemingly ineffective by the truth that their creators are selling them rather than focusing on using their inventions for their very own trading.

When pursuing

simply click the next web page trading, an excellent tip is to all the time carry a notebook with you. Whenever

index hear of one thing fascinating concerning the market, jot it down.

mouse click the following web page that are of interest to you, should embody market openings, cease orders, your fills, price ranges, and your individual observations. Analyze them every now and then to try to get a feel of the market.

When creating your Forex charts, remember not to flood them down with too many indicators. An indicator isn't telling you anything new. The whole lot it's worthwhile to see is already on the screen. And by putting too many indicators up, you are not solely wasting time but you are also confusing issues with the clutter.

As you read, the extra you can enhance your profitable proportion, the better you are going to do out there.

Click At this website behind studying the following pointers must be to get you ready to make the best strikes available in the market. Making use of what you learned all through this article will put you in an incredible position.

UNDER MAINTENANCE